Overview

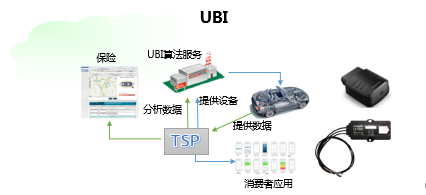

The auto insurance pricing model has long been subject to a lack of accuracy in the field of auto insurance, which results in a high cost of vehicle insurance business and a general loss in the insurance industry. With the advancement of market-based pricing reform, the insurance companies began to pay attention to the UBI vehicle insurance pricing model based on the usage and owner habits. However, this model has gradually become a mainstream auto insurance pricing method in Europe and the United States. The car aftermarket OBU/OBD+UBI platform mode is nowadays the mainstream model of IOV UBI markets.

Highlights

- Select top-quality customers to realize the floating car insurance

- Fast claims, to realize the comparison and analysis of back-end data

- Remote loss assessment, directly assess the loss through data condition analysis and site photos

- Improve the services, take the initiative to care for car owners and provide the reminder or help services through the data

- Read vehicle body data, increase the value-added services such as twitter of short-term insurance, and the derivative services of financial management products, etc.

Hardware Terminal

ADC and GPRS, and other services, and collects the car status, driving mileage, driving behavior, and other data. Gosuncn has a full range of 2G/4G UBI terminal products. Customers can flexibly choose OBU or OBD products according to their business needs. The product has a strong positioning ability and it adopts the dual-star differential positioning system to ensure the shortest GPS startup time. Even among the narrow high-rise buildings, it can still locate quickly and accurately. For example, domestic customers can choose the combination mode of “GPS + Beidou” satellite positioning. The product has better robustness. It can still maintain the signal stability even it is mounted in a concealed position.

- Micro-control unit chip

- MT6261D used in the platform

- high GPS sensitivity

- short startup time

- support for several different microphones and speakers

- 3-axis acceleration sensor

- 3-axis gyroscope

- built-in SIM card

- support for emergency calls

Platform/APP

Based on the big data platform, the data collected by the terminal is analyzed in depth to establish a UBI algorithm model such as driving behavior of car owner, vehicle faults, etc. and provide the refined insurance product solutions for the insurance company to accurately position the users. The collision tests, collision data records, and fast loss notice for collisions provide the effective evidence for the claims management of insurance companies, which effectively avoids the fraudulent insurance events and reduces the overall cost of car insurance. Gosuncn has OCTO, Net4things and other UBI platform partners in the world. The platform partners have rich data accumulation and experienced application cases in UBI algorithm and collision analysis, and so on.

Applications

- Car insurance, realize the floating car insurance and improve the claims efficiency according to the driving behavior of car owners

- Vehicle fleet management, conduct the on-site scheduling and gather and optimize the vehicle resources

- Auto 4S stores, provide more perfect services to the customers

- Logistics management, precisely position or locate the vehicle